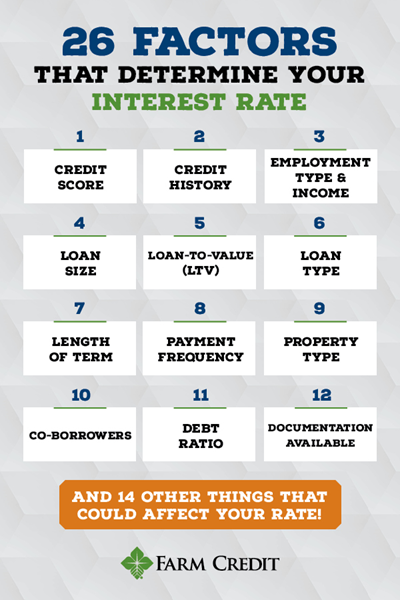

26 Factors Determining your Interest Rate

How are interest rates determined?

If you have or are currently lender shopping (financial best practice!) before deciding where to get your loan, you’ll notice that the interest rate offered varies from place to place. Simply put, interest rate is a reflection of risk. When the market identifies a higher risk, this demands a higher rate of return.

There’s always more to a lender than the interest rate alone, but there are around 26 different factors that go into quoting your interest rate.

Top 12 Factors that Determine Interest Rate

- Credit Score

The higher your credit score, the lower the rate.

- Credit History

The less credit history you have, the less knowledge a lender has of your repayment ability, possibly making you slightly more risky. The better the payment history, the better the rate.

- Employment Type and Income

Self-employed, hourly employed, bonus-based pay – these all affect the risk factors of whether you’ll be able to pay back the loan.

- Loan Size

How much money are you asking for? Often if you are requesting an amount under a certain level (i.e.$100,000), there may be a slight increase in rate.

- Loan-to-Value (LTV)

What percentage is your loan amount to the value of the property? Typically, the lower the percent, the lower the rate.

- Loan Type

Fixed, variable, adjustable, balloon – these all have varying rates because of the variation of risks. Depending on the situation, your initial interest rate may be lower with an adjustable rate than with a fixed rate but you run the risk of the rate increasing significantly later on.

- Length of Term

The shorter the term on your loan, the quicker you’ll be paying down the debt; possibly resulting in a better rate. It’s important to note that your payments will most likely be higher, so you’ll want to make sure you can afford it.

- Payment Frequency

Because of the agriculture industry’s unique nature, if you elect for a payment plan that allows for an annual or semiannual payment rather than a monthly one, you can expect a higher rate.

- Property Type

A residential house will have a lower interest rate than a commercial farm on 50 acres because of the increased risk that comes with a farm loan. Purchasing a farm or land is different because there aren’t as many properties for value comparison, buyers or people that can afford to.

- Co-borrowers

Will there be other people on the loan, and if so, what does their credit look like? All parties involved in the loan will be used in determining the rate.

- Debt Ratio

How much money is made monthly versus the cost of monthly bills. The typical ratio that lenders looks at is 42%.

- Documentation Available

Are you able to produce all documentation (bank statements, taxes, retirement accounts, etc.) to show your assets? This will help ease the risk factors for a lender and help lower the rate.

14 OTHER FACTORS THAT COULD AFFECT YOUR INTEREST RATE

14 OTHER FACTORS THAT COULD AFFECT YOUR INTEREST RATE

Escrow Preference

Some lenders require escrows for residential or consumer loans. This means specific money put aside to pay for things like taxes, insurance, etc. If you choose not to escrow, your rate could be higher due to higher risk.

Closing Date

Depending on the market temperament, it can be important to lock in on a rate that is as close to your closing date as possible. The longer the rate lock period, the higher the rate will be.

Occupancy Type

Typically, rental or investment properties have higher interest rates.

Residency

Rates will be lower if you plan to live in the house full-time versus using it as a second home.

Available Assets

What additional assets do you have as possible collateral? The more down payment you have, usually the lower the rate.

Asset Seasoning

How long have you had your assets? There may be restrictions for assets owned under a certain time frame that could affect the rate.

Housing Ratio

What does the ratio from above look like when you add in the cost of the mortgage? Usually a good housing ratio is 28%.

Improvements Needed

This will affect the value of the property. Remember that the lower the percentage of the loan amount to the value of the property, typically the better the rate.

Employment History

This also affects the risk to the lender. If you show a consistent history of employment, the better chance for a lower rate.

Relocation

Are you being temporarily or permanently relocated by an employer? That will determine if the house is considered a secondary (higher rate) or primary residence (lower rate).

Seller Contributions

If the seller is able to contribute money towards closing costs, that will increase the amount you have available for a down payment.

Gifts

Again, lowering the amount of loan you’ll need with gifts from family members will help to lower the interest rate.

Cash-out

If you refinance and want to walk away from closing with money in your pocket, you may be increasing the percentage of loan to property value.

Combined Loan-to-Value (CLTV)

This ratio includes not only the current loan you are wanting, but any additional loans on the property, such as a home equity.

You don’t have to remember all of these, but if your lender is quoting you a rate without asking some of these questions, be sure to ask them what criteria they are using to factor your rate.What determines my interest rate?

How to Compare Loans Side-by-Side

THERE’S MORE TO A LOAN THAN JUST THE INTEREST RATE.

Yes, the interest rate is important and is probably one of the first questions you want to ask, however, don’t forget to find out the following:

- Can you reset the loan at a lower rate if interest rates come down? How much will it cost you?

- Is there a prepayment penalty if you want to pay ahead or pay the loan in full?

- Does the lender give great service?

- Do they answer the phone or return calls promptly?

- Can the lender get the loan completed in a timely manner?

A few key things you should compare may include (but may not be limited to) some or all of the following:

- Application fees

- Appraisal costs

- Settlement costs

- Attorney fees

- Title insurance costs

- Loan origination fees

- Servicing fees

At Farm Credit of Central Florida we provide financing for farms, homes and land. If you have questions please visit our website www.farmcreditcfl.com or reach out to your loan officer by calling 863-682-4117.