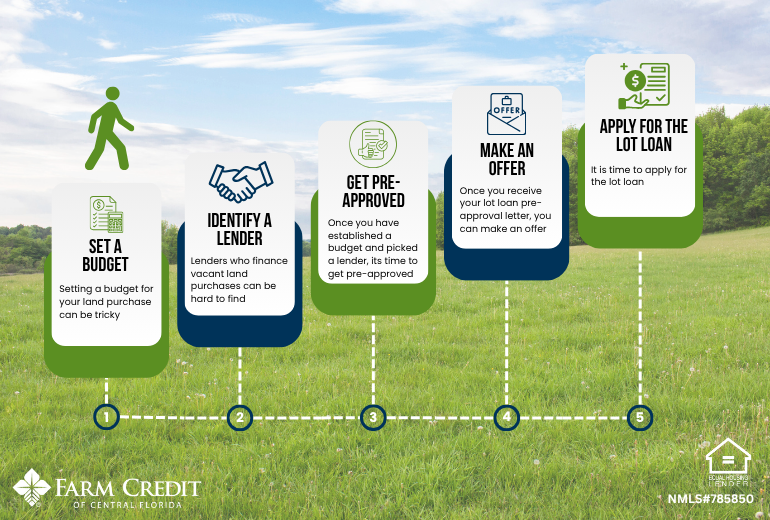

Your Guide to Getting Pre-Approved for a Lot Loan with Farm Credit of Central Florida

Are you dreaming of buying rural land to build your dream home on? If you are beginning to shop for land, then setting a budget and getting pre-approved for financing are crucial first steps. Farm Credit of Central Florida offers specialized lending solutions to future rural homeowners, and getting pre-approved can give you a significant advantage in today's competitive market.

Step 1: Set a Budget

Setting a budget for your land purchase can be tricky! With so many factors to consider, like acreage, location, and future home costs, it can be hard to set a budget for the land purchase, this early in your long-term plan. Luckily, there are endless resources online that can assist you in this first step.

Step 2: Identify a Lender

Lenders who finance vacant land purchases can be hard to find! Every lender has different down payment requirements, rates, terms, and approved current or future uses of the land. Asking every question you have and telling the lender as much as you can about your plans can help you choose the correct lender to get pre-approved through. Once you do find a lender who can accommodate your financing needs, you should ensure you meet their eligibility standards before applying. The idea behind getting pre-approved, is that you will use the same lender for your full application, so choose wisely!

Here at Farm Credit of Central Florida, we take pride in ensuring we help you get this step right! Get connected with a loan officer today to begin inquiring about a lot loan pre-approval!

Step 3: Get Pre-Approved

Once you have established a budget and picked a lender, it is time to get pre-approved for the lot loan. Don’t wait until you find the perfect piece of land to begin the pre-approval process; You might miss out! Most realtors require their prospective buyers to be pre-approved before to making an offer to the seller. Having your pre-approval letter in hand shows your realtor and the sellers you're a serious buyer.

On the pre-approval application, you will list the desired term and amount you are requesting. Along with the application, you will submit a copy of your driver’s license and give consent for your credit to be pulled. Pre-approvals are credit-based decisions, and full financials are not required. This approach makes the process simple and easy!

Step 4: Make an Offer

Once you receive your lot loan pre-approval letter, you can make an offer! Lot loan pre-approval letters are valid for 90 days, and can be used for purchasing land in a USDA rural area, with the intention of building your primary residence on the land in the future.

Step 5: Apply for the Lot Loan

Once the seller accepts your offer and you have signed a purchase contract with them, it is time to apply for the lot loan! If it is still within the 90-day timeframe, and your pre-approval letter is valid, then we won’t need to pull your credit again. This makes the application process smoother, and we only need you to complete the full lot loan application and submit any additional required documents for us to be able to underwrite the loan. The additional documents we typically require or collect are a copy of the signed purchase contract and verification of liquidity, pertaining to the down payment requirements.