Strawberry Imports

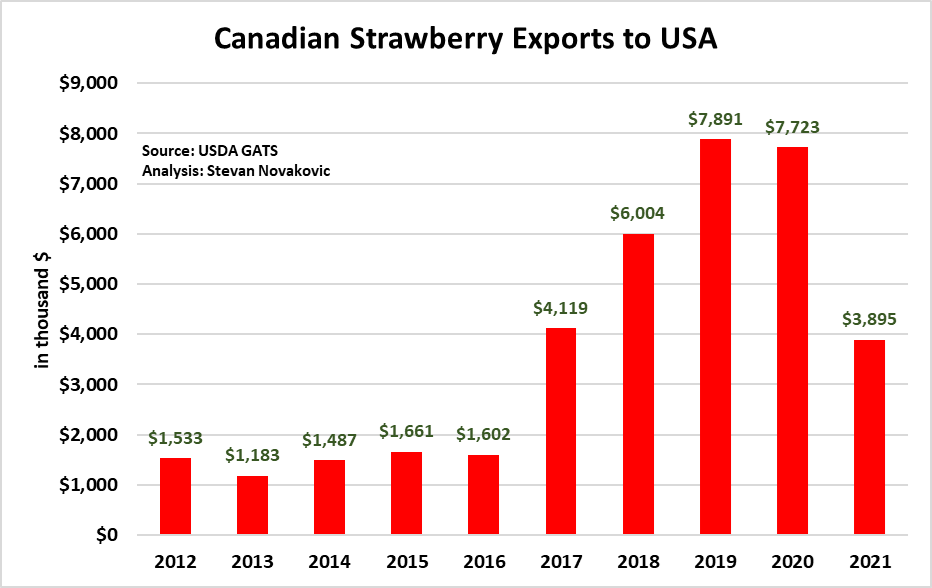

When it comes to US strawberry imports, we pretty much covered it in the last blog. More than 99% of the berries Americans eat from outside the country originate from Mexico. But that does not mean what little we consume from other countries is unimportant, though relatively insignificant. Consistently over the past five years, the US has purchased multi-million dollar totals from Canada, an increasing contingency of which is greenhouse grown. For American consumers, the Canadian berry is primarily a niche product, but it plays a special role in making up for shortfalls in supply from domestic and Mexican growers. Typically, the Canadian outdoor field production harvest period is between late May and early July and lasts only about a month. Though California harvest is in full swing then, there are sometimes arbitrage opportunities for stores to bring in strawberries from closer by in the northeastern portion of the US. Delays and backlogs and shipping also serve to place Canadian exports as a natural backstop in some regions of the country. Primarily for these two reasons, there are relatively wild fluctuations in the dollar amount of US strawberry imports from the Great White North. Overall, total strawberry acreage across Canada is slightly less than in Florida, around 10,000 acres.

Other American strawberry imports are minuscule and are often specialty products geared towards certain ethnic tastes and bound for those client-specific stores. For example, the US imported over $500,000 of Japanese strawberries in 2020 and 2021 and between $120,000 and $370,000 of South Korean strawberries from 2018 through 2021. While Peru and Chile have ramped up exports of other fruits to the US, neither has sent strawberries north to the US for the last few years. While in the past the Netherlands and Belgium have shipped small loads of berries to the US, that has recently died down, with Turkey being the only European nation to export over $300,000 in the past decade. The furthest country sending strawberries to the Lower-48 has been New Zealand, which shipped $120,000 worth back in 2020. So, as American producers look on the competitive horizon, Mexico remains the greatest exporter of strawberries to the country, with no one close behind. Canada, as a distant second, would be forced to massively increase greenhouse production, but, as a net importer, most new production would remain domestically. While it is possible Chile, Peru, or Argentina could one day be players in the industry, they are a long way from ramping up to $800+ million in exports. Turkey’s proximity to Europe/MENA and New Zealand’s proximity to China infer those berries will generally remain regionally.