Increases in Mexican Strawberry Production

The removal of trade barriers is typically marked by redistributive outcomes, often the shifts in production due to regional arbitrage. One of the most noticeable results of the North American Free Trade Agreement (NAFTA) was the influx of Mexican produce into the United States. In the case of the relationship between American agriculture and its friend to the south, labor and environmental regulations in Mexico were more favorable for manually harvested crops, whereas the US had (and has) economies of scale and mechanized techniques that made (and make) commodity grains/softs comparatively more efficient to produce. This advantage was quickly recognized, and Mexican agriculture’s momentum was shifted away from subsistence-style grain farming towards fruits and vegetables. NAFTA’s signing in 1994 was perfect timing for this labor switch as it came amidst Mexico’s ending and legally unwinding its ejido (communal farming) program, privatizing the land holdings (latifundios). What followed was a rush of ejidatarios (communal farmers) and other rural workers leaving small parcels of maize and sorghum to pick strawberries and rush north across the Rio Grande in search of new job opportunities.

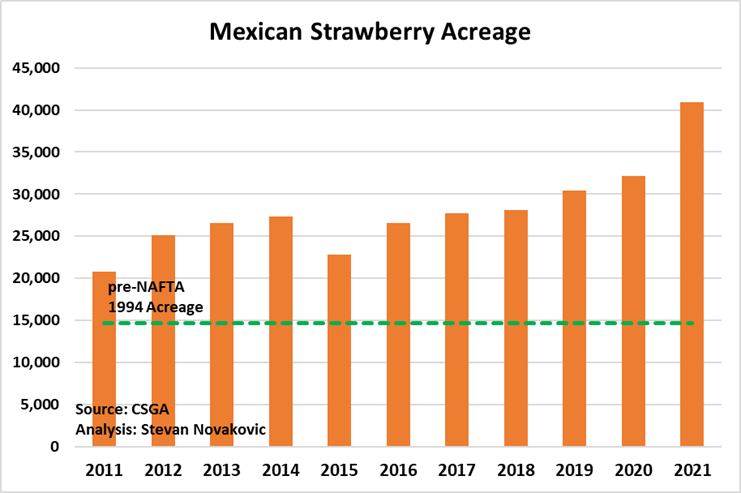

Mexican agriculture transitioned its crop portfolio with lightning speed as NAFTA incentivized growth in sectors that previously were encumbered by tariffs. US tariffs on fresh Mexican strawberries were ended in 1994, and frozen rates were gradually reduced until total removal in time for the 2003 crop. USDA’s Global Agricultural Information Network (GAIN) in the past released an annual strawberry report on Mexico but ceased to do so in 2002. Early reports, however, estimated post-NAFTA 1996 Mexican total acreage at 15,138. By 2002, that number had declined as growers increased investments in greenhouses, hoop houses, and other structures to be more efficient. Within a few years, however, fields were once again expanding. In 2011 the California Strawberry Growers Association (CSGA) estimated Mexican total acreage at 20,814, an increase of 51% from USDA’s 2001 report. Another decade later (2021), CSGA nearly doubled Mexican acreage estimates to 40,900 – a jump of 96.5% for a compounded annual growth rate of 6.99% over those ten years. This meteoric rise shows no signs of slowing, with CSGA’s most recent forecasted 2022-23 season acreage at 55,222 (due to a recent change in their methodology, however, the numbers may not be entirely comparable).

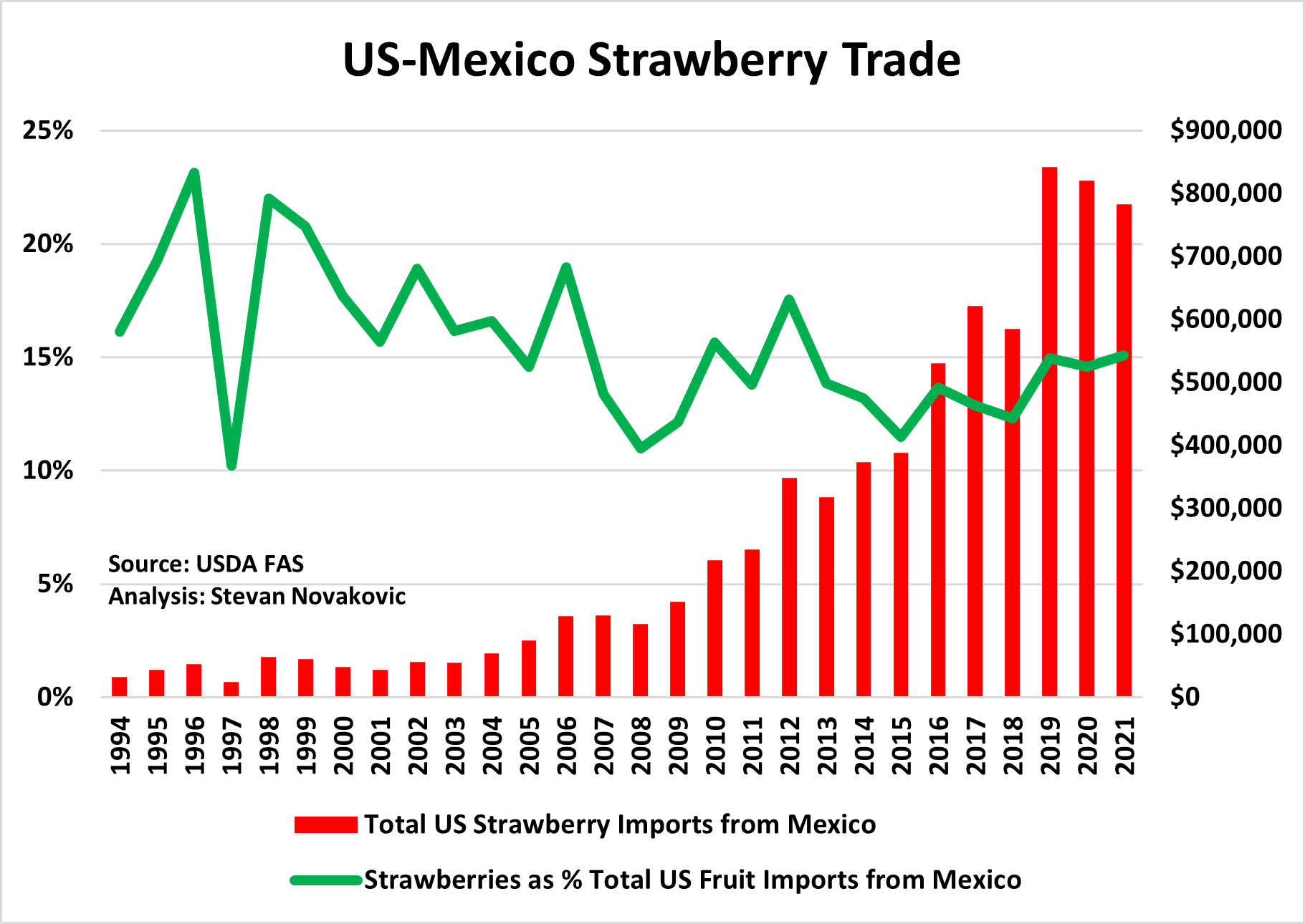

As acreage and production totals have ascended in Mexico so have the annual dollar values for what gets exported north. About 90% of Mexican berry exports are bound for the US, and the data reflects that. Pre-NAFTA 1994 American imports of Mexican strawberries totaled only $31.9 million. While it took a few years to ramp up production and rectify land use issues with the ejiditarios, within a decade outward trade flows had more than doubled to $70 million, and that was only the beginning of the expansion. According to USDA’s Foreign Agricultural Service (FAS), the total dollar value of Mexican strawberries imported by the US peaked pre-pandemic in 2019 at $842 million, an increase of more than twenty-five times (2,500%) greater than the last year before NAFTA went into effect. The impressive explosion of Mexican exports has not singularly been in strawberries, and the crop only accounts for about 15% of its fresh fruit sent to the US. Avocados lead the way, and blueberries have outpaced strawberries (in dollars) on multiple occasions. Overall, Mexico’s produce exports to the US are widely varied, with substantial growth across categories.

But with that growth, there are external effects, especially on producers north of the Rio Grande. In the States, strawberries are grown almost entirely in California (c. 90%) and Florida (c. 10%) with little seasonal overlap due to climate. Mexico, however, has multiple regions where strawberries can be harvested. The largest state for production there is Michoacan, which fluctuates between 45-50% of the nation’s total and has a harvest peak from November to February: directly in competition with Florida. Guanajuato, another large producer, peaks from February through April, competing with the last few weeks of Florida’s top harvest period.

Going forward, American strawberry producers can expect Mexican acreage to continue expanding, especially as consumers’ demand for the fruit has strengthened over the years. Central Florida strawberry growers should know that increases in Mexican production are more likely to directly impact them, rather than the larger California industry. Mexico remains a lower-cost producer, with less environmental and labor oversight as well as an available rural workforce. In the future, however, as nearshoring in tech, automotive, and services expands, higher-paying sectors may poach some employees. Concurrently, with an increasing migrant footprint in Mexico from Honduras, Guatemala, Nicaragua, and other Central American countries, shortfalls in the rural labor pool may be refilled quickly. Supported by a variety of growing regions, an abundance of potential workers, and favorable demand forecasts Mexican strawberries will continue to exert influence on the US market.